Tax Bracket 2025. The internal revenue service (irs) has released adjustments to tax brackets for 2025, adding thousands of dollars to most marginal tax brackets, and potentially protecting. Understanding your tax bracket and rate is essential regardless of.

You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax years. The general slab rates applicable in the case of an individual or huf are 5%, 20%, and 30%.

2025 Tax Code Changes Everything You Need To Know, Use the income tax estimator to work out your tax refund or debt estimate. Your bracket depends on your taxable income and filing status.

Tax Brackets 2025 Philippines Roz Leshia, Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year. In today's budget 2025, the finance minister nirmala sitharaman has made changes in the income tax slabs and rates for the current financial year.

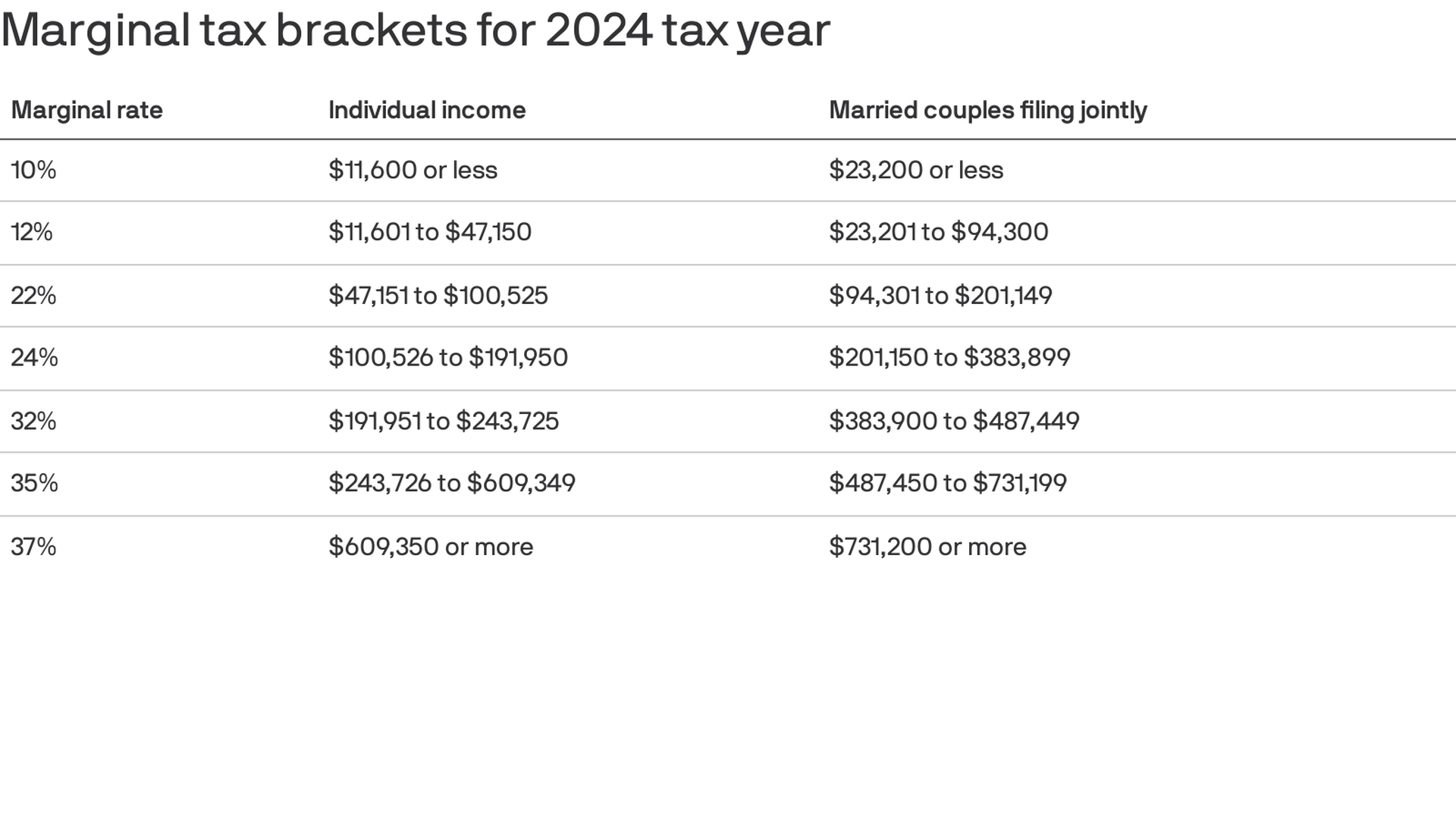

Tax Brackets 2025 Australia Pdf Devi Kaylee, Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax rate schedules. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

IRS Sets 2025 Tax Brackets with Inflation Adjustments, There are seven tax brackets for most ordinary income for the 2025 tax year: An individual has to choose between new and old tax.

2025 Tax Brackets South Africa Emyle Francene, When your income jumps to a higher tax bracket, you don't pay the higher rate on your. An individual has to choose between new and old tax.

2025 Tax Brackets Married Filing Jointly Uk Hilde Charlotte, The top marginal income tax rate. Also, check the updated tax slabs for individuals.

Tax Brackets For 2025 Vs 2025 Taxes Nita Valina, Also, check the updated tax slabs for individuals. Your taxable income is your income after various deductions, credits, and exemptions have been applied.

Irs Tax Brackets 2025 Federal Ella Nikkie, In today's budget 2025, the finance minister nirmala sitharaman has made changes in the income tax slabs and rates for the current financial year. The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Tax Brackets Doro Cissiee, The general slab rates applicable in the case of an individual or huf are 5%, 20%, and 30%. These rates apply to your taxable income.

Tax Brackets 2025 Irs Single Linda Tamarra, Enter your income and location to estimate your tax burden. Your taxable income and filing status determine both the tax rate and bracket that apply to you, outlining the amount you’ll owe on different portions of your income.

In today’s budget 2025, the finance minister nirmala sitharaman has made changes in the income tax slabs and rates for the current financial year.